Escrow account: why entrust your payments to a trusted third partyArticle

10 January 2024

Summary

There are two possible approaches to integrating an escrow account

When it comes to securing their transactions, C2C marketplaces can take two approaches. In the first group, there are very established players where Vinted, Leboncoin and others have enough experience and skills to entrust the integration of an escrow account payment to their internal teams.

They thus give pride of place to the developments of an escrow account owner and are able to compete with the best solutions on the market. Their concern is to tailor to maintain control of a process whose strategic scope (customer satisfaction and retention) they have already understood and the role in enhancing the value of their model.

In the second group, the majority, people choose to delegate the security of their transactions to a trusted third party with an escrow account. There are lesser-known but growing platforms that prefer to save time in a correct control of these processes. They do not intend to internalize this escrow account in the short term, as they are already engaged in a race to critical size in their market.

Why should every C2C marketplace outsource the security of its transactional flow?

First of all, the platform wishing to outsource the escrow account of its value chain will turn to a technological partner, a true trusted third party. It is a specialized publisher that has proven itself, and whose track record testifies to the effectiveness and adoption rate of its solution.

This solution will integrate various functionalities (anti-fraud flows, delivery methods, tailor-made payment methods with escrow account, compliance and litigation management, etc.), which are logically more powerful and more advanced than if the platform built its solution by its own means (expertise, development budgets, etc.) – we except, however, the leaders of the "first group" presented above, because of their power and access to capital to finance their R&D.

To get to know the business model of second-hand players, let's remember that it is rather greedy in terms of marketing budgets. To get out of their "red ocean", marketplaces must compete in terms of visibility and therefore SEO and advertising investments (SEA, SMA) if they want to make themselves known and identify consumers during key sequences: end-of-year celebrations, Valentine's Day, Mother's and Father's Day, Black Friday, promotions, private sales, sales, etc.

It is not in their habit, or even in their interest, to ask their teams to look into these issues or to recruit experts to manage them "in-house". They know they can't compete with the best solutions on the market, which have been developed sometimes after a lot of research and improved by continuous benchmarks.

What's more, the security of transactions between individuals cannot be accommodated with more or less or cobbled together solutions. Here, there is no no code, or learning by trial and error. The risks are far too high, especially since ingenuity and dishonesty tend to focus precisely on these processes, given the financial stakes.

Reputational risk to platforms is high

If their added value is not that of the manufacturer but of the distributor, at the end of the day it is they who will be blamed if the shopping experience goes badly.

If we had to draw a parallel, look at what happens in the event of a scandal and the withdrawal of a food product – especially if it is widely publicised: the finger is pointed at the manufacturer, of course, but by extension or contagion, the name of the distributors is always affected. "How come they haven't checked the quality of what they sell us? ", "They should be more vigilant", "We can no longer trust anyone" users will say to themselves out of dismay and not without legitimacy, even if they know nothing about the ins and outs of the case.

Well, it's the same on second-hand marketplaces. Except that the grievances will shift from the intrinsic qualities of the product (knowing that it is second-hand) to the end of the chain, i.e. the guarantor of protection. If it suffers a hiccup, a failure, the confidence capital will evaporate faster than it took time to settle:

- Disappointed end users won't set foot there again and won't fail to vent about their misadventure with a salty review on Google or Trustpilot...

- Internet users who have never tried it but who have had the desire to do so during future promotions or private sales, will pass on their way for fear that it will happen to them. And this is even though, statistically, it can happen on most platforms;

- Finally, and perhaps this is the worst, such a mishap does not do the brand with the logo of the product(s) concerned. Although it does not control the deposit by individuals, it is impossible to prevent a certain association of ideas in the minds of users, knowing that, for products reputed to be expensive (especially technological or luxury), the risk of fraud is notoriously higher.

Platforms wishing to protect themselves from reputational risk towards their users, as well as the brands that are the indirect users, therefore have every interest in entrusting the security of their payments to a trusted third party who will provide them with technicality, advice and tailor-made integration of the escrow account.

Finally, let's not forget that there is a "market agenda" conducive to the adoption of these solutions. Indeed, with the continuous decline in the purchasing power of the French, they logically turn to marketplaces for the purchase and sale of second-hand products and are in favour of protection by escrow account.

If the latter then see their traffic and transactional volumes soar, so does their risk of fraud and disputes. A fundamental trend that will ultimately penalize all the protagonists.

That's why, second-hand players, it's more than ever time to use a trusted third party to secure your users' transactions via an escrow account.

Are you starting a second-hand project?

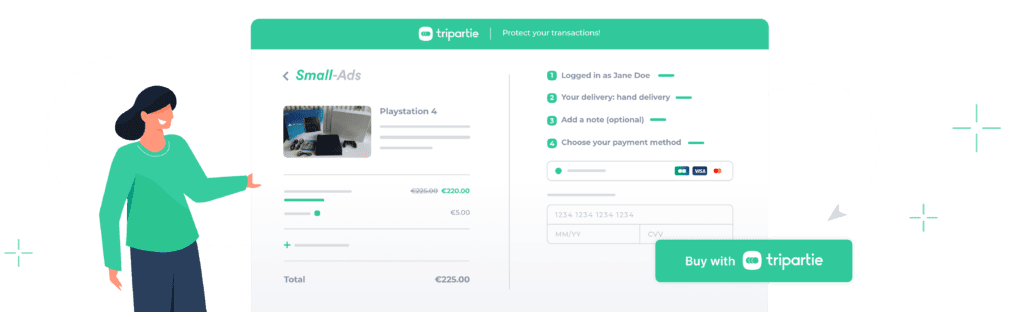

Tripartie enables retailers, marketplaces and large companies to enter the peer-to-peer and second-hand market rapidly, without operational and reputational risk.

Tripartie has a trust-based approach and provides a set of tools to ensure secure, compliant transactions and efficient user dispute resolution, including the provision of an escrow account. Book a product demo!