Spanish Marketplace: which C2C payment service provider to choose? Article

March 11, 2024

You've come to the right place if you're looking for which payment service provider to integrate into your Spanish marketplace. In this article, we provide you with the keys to understanding the different technical possibilities available to you, their advantages and disadvantages, what is the applicable legal framework and which are the main players operating in Spain.

You can also read our article on how to easily integrate InPost on its Spanish marketplace.

The market for peer-to-peer and second-hand transactions in Spain is growing strongly, driven by citizens' ecological considerations and the desire to preserve purchasing power. It should be remembered that e-commerce in Spain is a market estimated by the MFI at 82 billion euros per year (i.e. 6.6% of Spanish GDP). This explains the emergence of a large number of generalist and specialized platforms.

The global second-hand market is worth more than €128 billion and is growing at a compound annual rate of +22% (See the full market study from Tripartie).

The content you will find within this article:

The legal obligation to use a payment service provider

Disclaimer: This fact sheet was written by the team Tripartie with the aim of clarifying the legal framework applicable to the payment functionality on a Spanish marketplace, as well as the obligations and risks arising from it, for all stakeholders. It is in no way a substitute for the advice of a legal professional and does not constitute any recommendation.

If you want to monetize your Spanish marketplace by taking a commission and manage paid transactions, you must comply with the applicable legislation and in particular the banking monopoly.

What is commonly referred to as the "banking monopoly" is the prohibition on any person other than certain categories of authorised entities from carrying out banking transactions regularly.

The European Union directives define the concept of a credit institution as "an undertaking whose activity consists in receiving deposits or other repayable funds from the public and in granting credit on its own account".

Spain's financial transactions laws stipulate that certain activities must be authorised by the Banco de España in advance.

The Banco de España is a public-law entity that acts as the national central bank in Spain. It is also responsible for supervising the Spanish banking system and other financial intermediaries operating in Spain.

These functions are carried out within the European institutional framework, of which the Bank of Spain is a member: the European System of Central Banks (ESCB), the Eurosystem, the Single Supervisory Mechanism (SSM) and the Resolution Mechanism (MUR).

It is therefore illegal to manually manage payments on behalf of the users of your Spanish marketplace, without prior authorization. Obtaining such authorization is expensive and requires expertise, which is why platforms use a dedicated payment service provider.

What is a payment service provider?

A payment services provider (PSP) is a company that allows online platforms to accept payments from their users. The payment service provider is therefore the link between the means of payment (credit card, bank transfer, etc.) and the platform by providing the latter with the necessary solutions to integrate and manage payments in full compliance.

The payment service provider is also responsible for fraud prevention, protecting sensitive data related to your users' payment methods and identity, verifying identity, and maintaining legal compliance.

How to choose the right payment service provider?

Generally, the first criterion we look at when selecting a payment service provider is pricing. Payment is often seen as a convenience, one wants it to work properly and both pay for it as cheaply as possible.

Beyond the price, it is important to compare the countries, payment methods and currencies supported by the payment service provider, to ensure that they are in line with the objectives of its Spanish marketplace. Will I carry out cross-border transactions? Will I internationalize my platform in the medium term?

Finally, the simplicity of integration, the performance of the integrated features (anti-fraud detection or KYC management for example) or reputation must be taken into account.

How do I integrate secure payment on my Spanish marketplace?

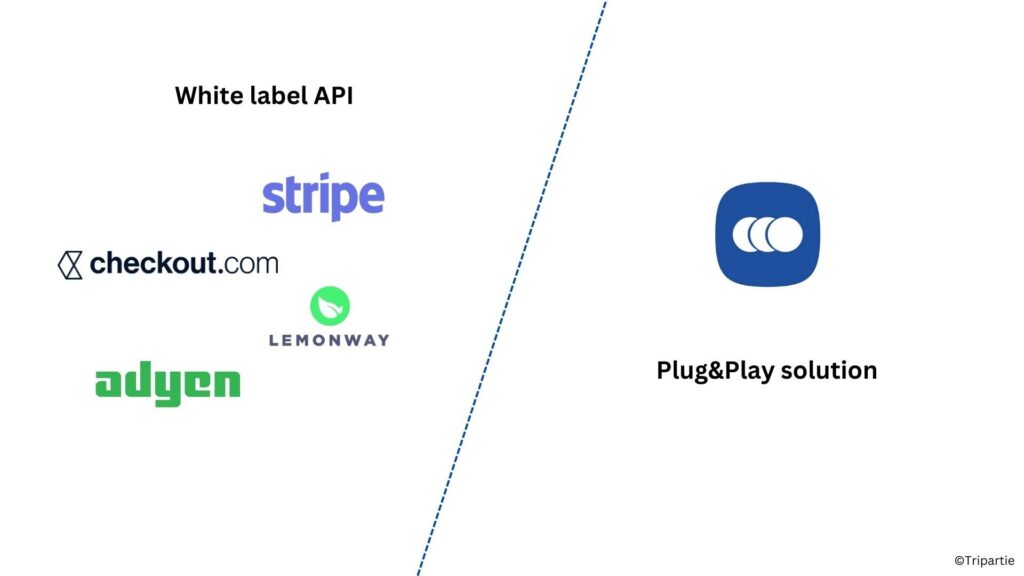

Now that we've explained why a payment service provider is a must-have on its Spanish marketplace, let's take a look at the two possible integration options.

| Option 1: Traditional white-label API integration | Option n°2: The integration of a Plug & Play solution (SaaS mode) |

| Advantage: You have complete control over the user experience and there is no mention of the payment service provider on your platform. | Benefits: The administrative activation of your account is instantaneous as soon as the contract is signed. User journeys are already integrated and ready to use. Technical integration is done in a few hours of work, which drastically reduces your IT development budget and lightens your product roadmap. The day-to-day tracking of transactions is done automatically, so you can focus on what really matters. |

| Disadvantages: The deployment takes a long time: minimum 6 months to compile your company's administrative file and have it validated by the payment service provider. All user journeys are to be developed by yourself, which requires a very strong involvement of your team. The costs associated with course development and technical integration are high. This type of integration involves monitoring the smooth running of payments on a daily basis via the payment service provider's dashboard. | Disadvantage: although the paths are generally configurable and in your colors, you do not fully control the user experience. |

At Tripartie, we are all about simplification and believe that your resources should be focused on building an offer, acquiring and creating an exceptional buying and selling experience. We therefore recommend the integration of a Plug&Play solution due to its speed and savings.

The main payment service providers operating in Spain

There are dozens of payment service providers in Europe, a few web searches make it quite easy to identify them. Below we list some examples that we think are relevant in the context of launching a Spanish marketplace. Indeed, not all service providers offer a dedicated offer to marketplaces. Sometimes, the payment service provider specializes only for BtoC e-commerce sites or payments in physical stores.

Feedback from Teorem.ch

Teorem is an application for buying and selling fashion items between private individuals operating in Switzerland. Launched by a fashion and second-hand enthusiast, Teorem quickly established itself as a benchmark. Today, the application enables users not only to create sales areas for clothing and accessories but also to hunt for bargains in the community's dressing rooms.

In 2020, while Vinted and other players in the sale of fashion items between individuals are expanding around the world, no solution exists for the inhabitants of Switzerland, a blockage due to the different legislations. It is in this context that Teorem was born.

With the mission to encourage more responsible and sustainable fashion consumption as well as to bring together second-hand enthusiasts, Teorem has more than 30,000 active users.

The security of transactions is a central issue since Teorem operates in a market where fraudsters do not fail to innovate and where the degree of satisfaction is not the same between two users, sometimes leading to disputes between them.

In its early days, the app only offered a service to connect individuals. The Teorem team then wanted to integrate secure payment to monetize exchanges.

How Tripartie helped Teorem achieve its goals?

Thanks to its unique technical and contractual architecture, Tripartie has made it possible to:

- An express deployment of the secure payment feature within the Teorem mobile app;

- The implementation of all the functionalities necessary for the smooth running of C2C transactions in a single integration: management of fraud, payments, parcel logistics and user disputes;

- Compliance with applicable payment-related regulations.

Tripartie Safe Checkout: an out-of-the-box solution in Spain

Tripartie allows you to invest in the second-hand market and transactions between individuals quickly, without operational and reputational risk. Our differentiation: Plug & Play solutions based on trust, integrating a payment service provider and allowing you to manage all transactions in your Spanish marketplace.

The Safe Checkout solution from Tripartie is a secure payment button accessible in SaaS mode that makes your platform's entire online purchasing chain more reliable:

- Reputational risk management – automated detection of scammers and fraudsters upstream of transactions through systematic verification of sellers and buyers,

- Secure payments – dedicated digital account until the purchase is validated by the users,

- Control the quality of goods and services exchanged - track shipments by parcel.

The team Tripartie has thought of everything for Spanish marketplaces :

Launching a Spanish marketplace? Book a product demo!