Payment on delivery: how two components secure purchases between private individuals Article

March 18, 2024

The content you will find within this article:

Cash on Delivery: Why these two dimensions matterand are linked in the payment transaction

In this article, we address these two themes together, because they work simultaneously. Indeed, in practice, payment is driven by routing events, the seller of the transaction receives his payment on delivery, which makes it possible to secure exchanges between individuals.

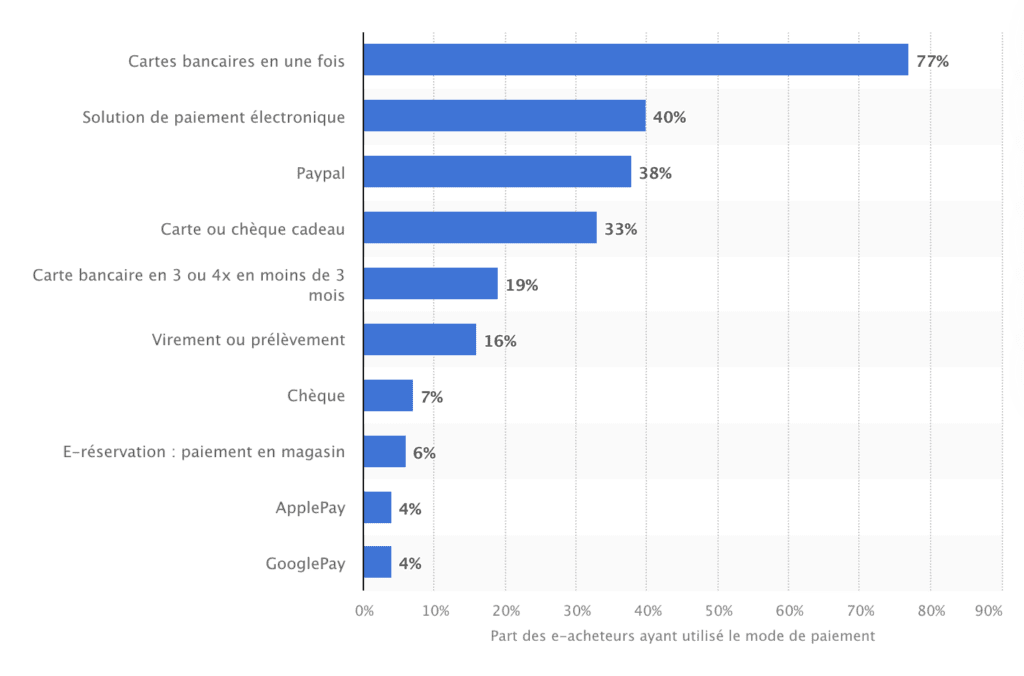

The choice of payment method is all the more important as the options offered to platform users have multiplied today – as shown in the graph below1:

To continue on the figures related to cash on delivery, the website of the Federation of E-commerce and Distance Selling (FEVAD) displays, among other things, that:

- E-commerce is the largest segment of the online payments market, with an estimated value of $6.03 billion in 2023;

- Globally, the online payments industry is expected to grow from $81 billion in 2022 to more than $360 billion in 2030, or more than 20% per year over this period;

- In 2022, 21% of French people surveyed made at least one online payment by computer per week, and 35% at least once a month;

- The number of online transactions worldwide reached 1.2 billion per day in 2022.

Choice of payment methods and cash on delivery

We know that this choice is part of the customer's personal strategy and that it is important at a time when their purchasing power is being undermined. In this context, split payments can be beneficial, and it is a reality that Tripartie integrates naturally into its solution – to preserve all the chances of conversion on your platform as well.

In concrete terms, the marketplace can manage the display of the different payment methods it offers, whether they are simple means such as credit card, Visa or MasterCard, or 100% local means. "For example, in Belgium, Tripartie works with Bancontact: a buyer located in the flat country will be able, at the time of paying for his purchase, to opt for this partner directly from the payment module of his platform, and if he works with us," explains Andréas Lambropoulos, our CPO. In this regard, and as we expand our geographical coverage, we are continuously expanding our partner ecosystem.

Another scenario, illustrating the personalization of the customer experience on this theme: the user of a marketplace offering used car parts, may be offered payment by bank transfer, here more appropriate than payment by credit card.

Finally, to return to the split payment, Tripartie is now working with two partners. We can thus offer their solution in the users' purchasing journey, for the platforms that choose it. "While we are the bearers of the technical solution, we are not the bearers of the contract from a legal point of view. So, to activate this specific payment method, the platform will have to enter into a contract with the operator concerned," says Andréas.

Regardless of the payment method chosen for the user, Tripartie ensures the same level of security and the seller always receives payment upon delivery of the order, provided that it is compliant.

Choice of carrier, preferences, and cash on delivery

Like payment methods, the choice of delivery and receiving methods is growing and becoming more complex. By embedding this intelligence in its solution, Tripartie gives platform users immediate visibility into its impact on billing, saving them time.

Tripartie integrates multiple transportation providers into its solution. "This means that delivery preferences and addresses are saved and then re-offered to users when they make online purchases," explains our co-founder.

"Thanks to APIs, carriers such as Mondial Relay or Colissimo send us an event batch for each delivery: for example, 'ok the package is being delivered' or 'ok the package is delivered'. Our algorithm interprets each of them to automatically trigger certain actions, without any human intervention," adds Andréas.

This allows our solution to automate the process of securing the transaction by managing payment flows. In this way, we ensure that a buyer gets what they paid for and the seller gets paid based on that information.

Another security feature is that the funds that have been placed in the holding account can only be released after the inspection period, which begins as soon as the parcel is delivered by the carrier, which is why it is referred to as cash on delivery.

As Andréas explains, we wanted to focus on the user's comfort. "The buyer pays the shipping costs and we create a shipping label. This avoids mistakes and the seller does not have to travel himself to get it. The buyer receives the label, prints it out and sticks it on the package, which he will ship – waiting to be informed that it will be sent to the buyer."

Thus, there is no longer any possibility of error, the process is automated just like the seller's cash on delivery. In terms of features, we cover all the transactional, in the manner of a Vinted if a parallel were to be made.

Another advantage of our solution is that it is easy to integrate. Thus, the ratio of functional coverage to implementational comfort makes Tripartie a key player in securing users' payments on platforms. To conclude, and we addressed this point in an article last month, it is important to be able to rely on a single account. Thus, regardless of the platform visited, Tripartie will provide the user with "this trusted portability" when we are responsible for managing this account.

Are you launching a second-hand project?

Tripartie enables retailers, marketplaces and large companies to enter the peer-to-peer and second-hand market rapidly, without operational and reputational risk.

Tripartie works on a trust-based approach and provides a set of tools to ensure secure and compliant transactions (including cash on delivery) as well as efficient resolution of user disputes. Book a demo!

1 Source: Statista

2 Source Fevad